Your Problems - Our solutions

Low Height Eave of

4-6 meter

Make-shift tin roofing with leakage

1.5-2 Ton/sqm weak

Floor Load

Capacity

Our Built-to-Suit Structures

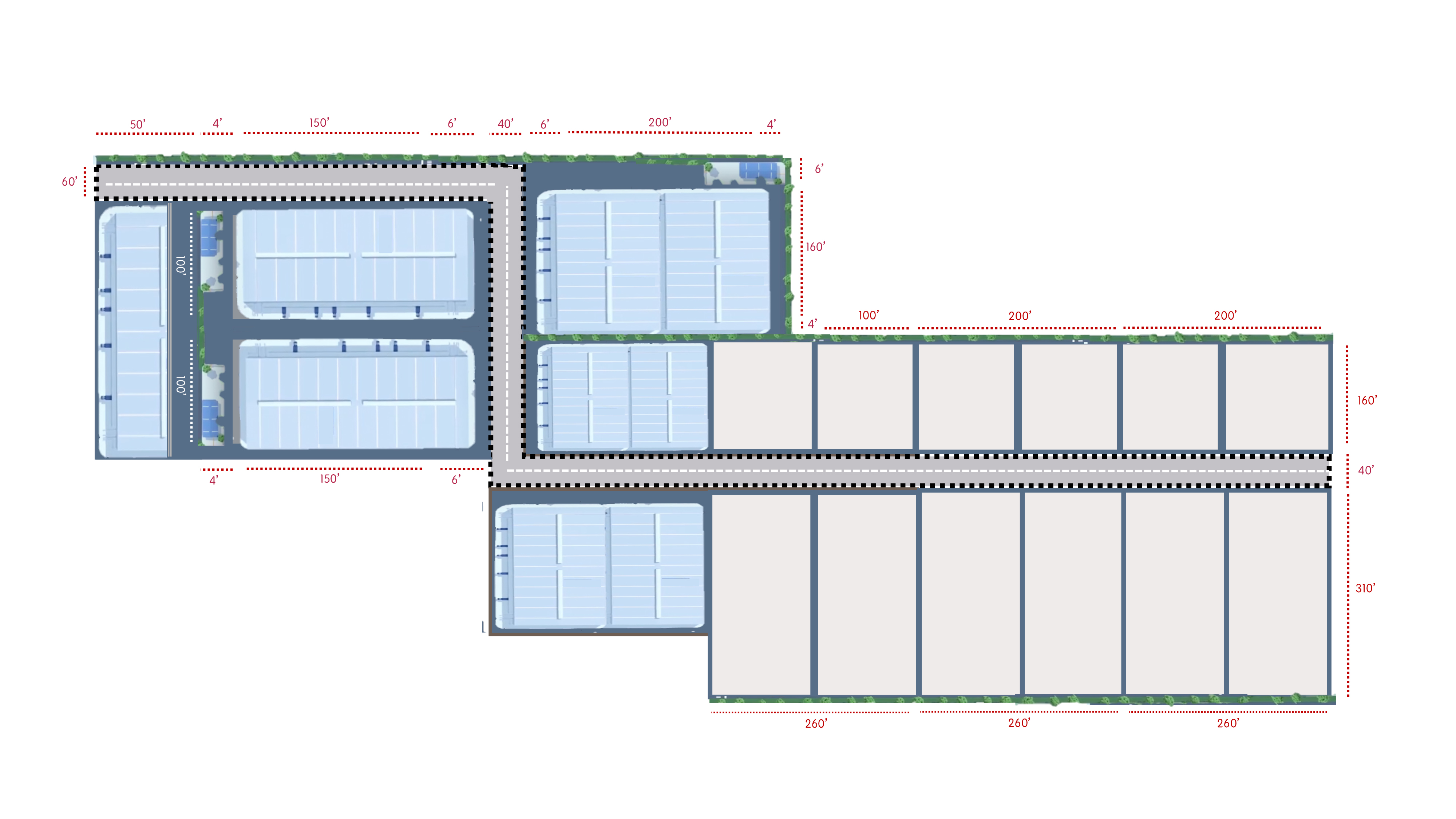

Building Aspect Ratio of Grade A park: 1:1.5-1.3

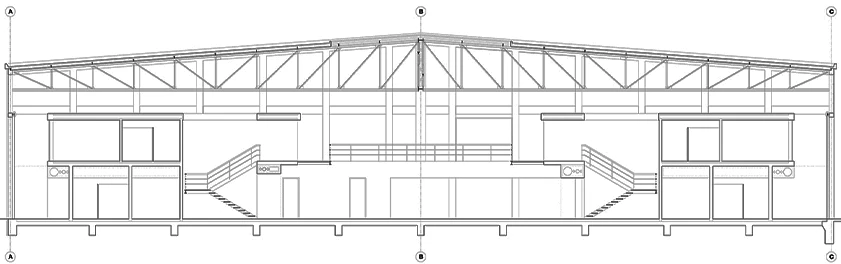

Minimum Height Eave of > 10 meter

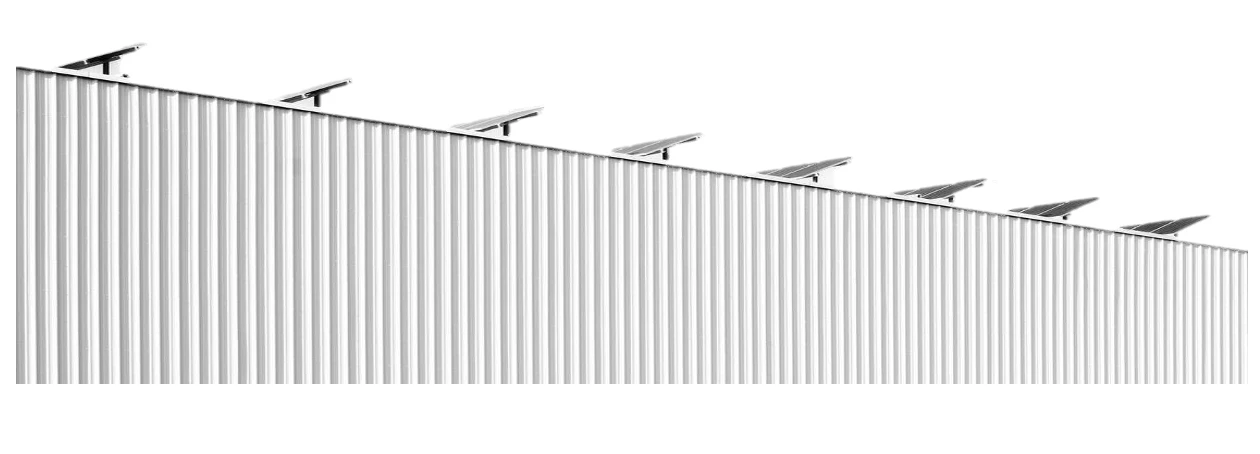

Galvanized Street with Skylights | 30 years warranty

5 T/sqm Minimum Floor Load Capacity - FM2

Problem: Poor Space Planning

Soln: Building Aspect Ratio of Grade A park: 1:1.5-1.3

Problem: Low Height Eave of 4-6 meter

Soln: Minimum Height Eave of > 10 meter

Problem: Make-shift tin roofing with leakage

Soln: Galvanized Street with Skylights | 30 years warranty

Problem: 1.5-2 Ton/sqm weak Floor Load Capacity

Soln: 5 T/sqm Minimum Floor Load Capacity - FM2

Problem: Building Exterior

Problem: Building Interior

Go-down, Shed, Old Factory, Building

Unorganized land parcels rented out as sheds

Poor space planning from internal road and connectivity to drainage and limited infra capabilities .

Earth-trial go-downs or foreclosed garment buildings from early 2000s without any amenities and poor compliance and safety standards

No adherence to International Standards

Grade A/B Compliant Facility inside our Industrial Park

Integrated well planned and intelligently designed private industrial park

Grade A spaces should support atleast 40 feet trailer and the internal roads should support the unhindered movement of cargo vehicles

Amenities like fire-fighting systems, CCTV surveillance, building insulations, drainage, security system, and other crucial factors must be planned well in advance to ensure efficient and sustainable operations

Adherence to International Standards

Challenges and opportunities

Challenges

Non-availability of warehousing and private industrial parks in Bangladesh

Opportunities

How are we different? Our competitive and 1st mover advantage

Difficulty of obtaining Bank Loan to procure land

Banks do not provide finance to companies to buy land hence majority businessmen come up with project profiles where its easier to get bank loan-namely Garment Manufacturing, Agriculture, Energy, Power and Information Technology.

Long-term Lens to Industrial Real Estate: We have been doing it since the 90s on our own land

Our primary business model is to earn rental income from our growing industrial asset class portfolio. We own, acquire and consolidate our asset positions and build on them to earn an income. Hence we seek a win-win association where we invest our capital for the potential client while they pay a rental lease on that while significantly lower their capital and operational cost that would have been blocked on acquiring and developing an infrastructure of this magnitude

A farily long term business with stabilized but low returns

Many are discouraged due to the sheer breadth of time required to acquire and then develop an industrial asset and convert it into rent producing assets and add to their equity value for a long period of time usually 15/20 years.

What we acquired or built for the last 30 years will not make sense now in 2023

We have invested heavily on our land development, boundary wall supporting infra. For instance consolidated boundary wall over the entire property, land development of 4,35,600 sqft, Built-up Structures, 4 MWElectric Power, while remaining debt free all along. This will not make sense for a new investor to buy land and invest on these in 2023 and earn rental income from the asset. Hence the entry to market remains low.

Preference of Residential and Commercial RE over the unfamiliar Indusrial RE

From site selection, to land acquisition to land development, facility specification, civil engineering, permission, licenses and approvals as well as delivering the projects and managing it

Genuine End to End Offering: We do not contract or outsource to any 3rd party

We do not just develop assets- we also construct, operate and own them, giving us an unique end-to-end capability and an ability to co-create with partners at every stage of the process. As a result, we can not only control costs but deliver optimal results within a specific time frame. So the moment we use our capital to build your building or supporting infra, rest assured about its quality as we are not only building for you but also for us.

Global Rise in Construction Material Cost

Materials cost rose by 40%. Overall construction cost 30%. Apart from steel, rod, bricks, cement, shortage of raw materials, increase in fuel price and freight cost contributed to higher import cost, post Covid & Russia-Ukraine war

We are essentially taking care of our own asset: We are not in the business of selling

Since it is our own estate, the maintenance and the upkeep of the park is regulated by us at a high standard on a daily basis. We are also in constant touch with our tenants about what we can do to improve, any snags that we can fix. All this puts them at ease that the developer is actually present to handhold them throughout the lifetime of the project unlike other third party agents or other land owners. Being an owner/manager mean we have a vested interest in the long-term success of our assets

Exponential Rise in Land price in valuable locations

With rising land rates and unaffordable rentals, warehouses are expected to gradually move towards the various internal roads in Gazipur and the periphery of the highway.Since land cost is the most critical component of warehousing development, it influences the realizable returns to a great extent. As purchase price of land goes higher, the realizable return reduces. Similarly, as the higher rental value increases, the feasibility of higher cost land goes up

Challenges

Non-availability of warehousing and private industrial parks in Bangladesh

Difficulty of obtaining Bank Loan to procure land

Banks do not provide finance to companies to buy land hence majority businessmen come up with project profiles where its easier to get bank loan-namely Garment Manufacturing, Agriculture, Energy, Power and Information Technology.

A farily long term business with stabilized but low returns

Many are discouraged due to the sheer breadth of time required to acquire and then develop an industrial asset and convert it into rent producing assets and add to their equity value for a long period of time usually 15/20 years.

Preference of Residential and Commercial RE over the unfamiliar Indusrial RE

From site selection, to land acquisition to land development, facility specification, civil engineering, permission, licenses and approvals as well as delivering the projects and managing it

Global Rise in Construction Material Cost

Materials cost rose by 40%. Overall construction cost 30%. Apart from steel, rod, bricks, cement, shortage of raw materials, increase in fuel price and freight cost contributed to higher import cost, post Covid & Russia-Ukraine war

Exponential Rise in Land price in valuable locations

With rising land rates and unaffordable rentals, warehouses are expected to gradually move towards the various internal roads in Gazipur and the periphery of the highway.Since land cost is the most critical component of warehousing development, it influences the realizable returns to a great extent. As purchase price of land goes higher, the realizable return reduces. Similarly, as the higher rental value increases, the feasibility of higher cost land goes up

Opportunities

How are we different? Our competitive and 1st mover advantage

Long-term Lens to Industrial Real Estate: We have been doing it since the 90s on our own land

Our primary business model is to earn rental income from our growing industrial asset class portfolio. We own, acquire and consolidate our asset positions and build on them to earn an income. Hence we seek a win-win association where we invest our capital for the potential client while they pay a rental lease on that while significantly lower their capital and operational cost that would have been blocked on acquiring and developing an infrastructure of this magnitude

What we acquired or built for the last 30 years will not make sense now in 2023

We have invested heavily on our land development, boundary wall supporting infra. For instance consolidated boundary wall over the entire property, land development of 4,35,600 sqft, Built-up Structures, 4 MWElectric Power, while remaining debt free all along. This will not make sense for a new investor to buy land and invest on these in 2023 and earn rental income from the asset. Hence the entry to market remains low.

Genuine End to End Offering: We do not contract or outsource to any 3rd party

We do not just develop assets- we also construct, operate and own them, giving us an unique end-to-end capability and an ability to co-create with partners at every stage of the process. As a result, we can not only control costs but deliver optimal results within a specific time frame. So the moment we use our capital to build your building or supporting infra, rest assured about its quality as we are not only building for you but also for us.

We are essentially taking care of our own asset: We are not in the business of selling

Since it is our own estate, the maintenance and the upkeep of the park is regulated by us at a high standard on a daily basis. We are also in constant touch with our tenants about what we can do to improve, any snags that we can fix. All this puts them at ease that the developer is actually present to handhold them throughout the lifetime of the project unlike other third party agents or other land owners. Being an owner/manager mean we have a vested interest in the long-term success of our assets

Landlord Profile

Inherited or bought land with no experience in industrial real estate business usually hailing from another profession or business.

Desperate to rent out empty land to generate cashflow hassle-free without investing on infra

Usually the land is mortgaged to a bank as collateral to finance other business ventures or owned by family with many siblings and stakeholders with dispute.

Landlord, Developer, and Asset Manager Profile

We own, acquire and consolidate our asset positions and build on them to earn an income. Hence we seek a win win association where we invest our capital for the potential client while they pay a rental lease on that while significantly lowering their capital and operational cost that would have been blocked on acquiring and developing an infrastructure of this magnitude.

We have a long term lens to real estate and invest and plan for the long term. We have been doing this for the last 34 years and continue to do so as our developmental plan and other verticals mature and run in full force; the basic goal remains the same to increase square footage of our industrial asset class and in turn rental income while being totally debt-free

Your Business, our capital

Running Project with Foreign Tanant

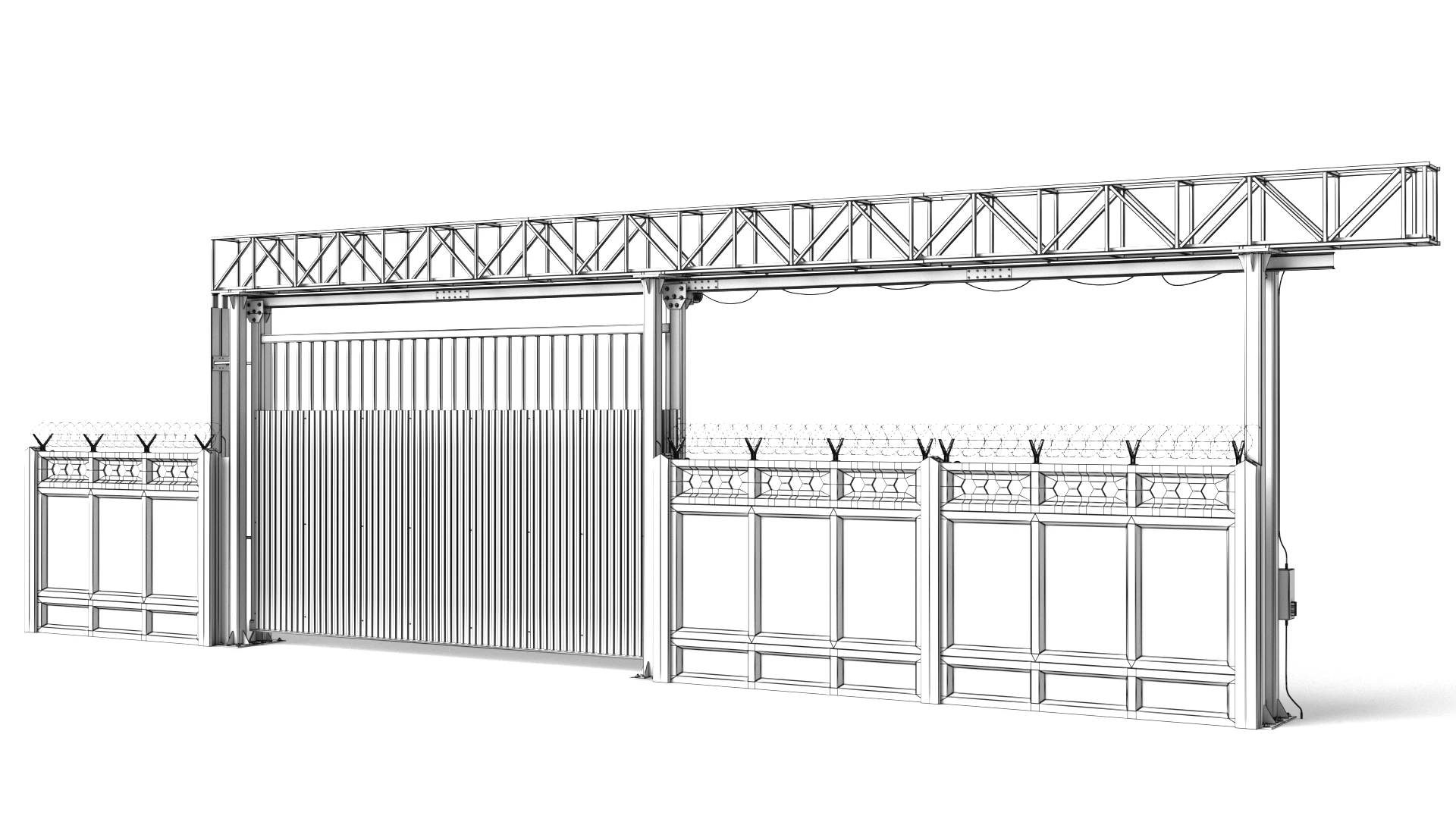

Fully Gated Community with 24.7 CCTV and Manned Security

Quick Startup:

Plug & Play

Lower project Gestation Period

Quick returns due to ready infrastruture

Running Project with Foreign Tenants

No Waiting Period like the state promoted Economic Zones

Designed with infrastructural and logistical demands of diverse industries

40 feet wide internal road

Ample greenery, plantation and drainage.

Park Management Security and Gate post

Ready Infra with globally compliant specs

Prime Industrial Hub unlike Govt. Economic Zones that are located in remote village areas away from the city

Scope for Expansion

Modern Amenities

Frees up capital for expansion

Financing and Operational Flexibility

Better Cashflow Management

Getting Land at Right Price

Ensuring that the land is clean and compliant

Obtaining licenses, approvals and clearance certificates.

Further investment on road, boundary wall, drainage, landfill, building construction.

One Company, One Process

We design, value engineer, manage construction, procure statutory approvals, plan permissions, handover the project on time and manage the property. We ensure that our customer need not worry about Real Estate. They can leave that to us and focus on their core business

What We do

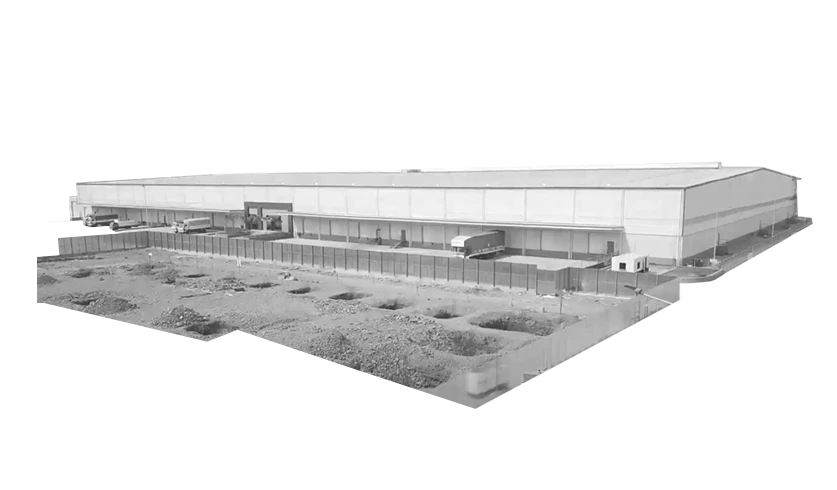

Built on land parcel of 15 acre (phase 1)

Fully Integrated, privately owned industrial and logistics park with 40 feet wide road with 3 MW Electric power featuring Grade A compliant buildings

Fully Gated Community with 24/7 CCTV surveillance and manned security

Grade A Industrial Spaces

Supporting Infra Development-land development, road, drainage, etc.

Managing End-to-End process as in-house construction wing

Built-to-Suit, Built-to-Spec

Buildings ranging from 15,000 to 75,000 sqft.

Transparent and Streamlined leasing process

Common Area Maintenance and Management

Versatile Buildings suitable for all MNCs, Ecommerce Online Marketplace. LightManufacturing, FMCG